Hello Threshold Community

I’m thrilled to share some exciting updates on tBTC integrations across several top DeFi lending platforms. These listings are the result of months of collaborative work I’ve been doing through each platform’s Governance processes. The goal? To make tBTC even more versatile, allowing you to borrow against it seamlessly and earn attractive yields—all while boosting its overall adoption and utility in the ecosystem.

I want to make a special thanks to @eh_ethan from tLabs for his invaluable support. We’ve teamed up on details, from proposals to implementation, to make this happen.

Also to the previous Threshold Treasury Guild and current Threshold Committee for their continuous support on the actions that were under their responsibility.

tBTC Now Live on AAVE’s Arbitrum and Base markets

tBTC has just been approved by AAVE’s governance and is now available as a collateral asset on both Arbitrum and Base markets, joining its existing spot on Ethereum mainnet.

This opens up fantastic opportunities for tBTC holders: Supply your tBTC on these Layer 2 networks with super-low gas fees (a big win over mainnet), and borrow stablecoins or other assets against it.

Paired with tBTC’s Direct Minting, Bitcoin holders can now tokenize their BTC effortlessly and receive tBTC straight to their preferred chain (Ethereum, Arbitrum, or Base) via a simple one-step process on the Threshold Dashboard. It’s all about making DeFi more accessible and efficient!

tBTC Expands to Compound Finance Base market

Building on its established presence on Compound’s Ethereum mainnet, tBTC is now live on the Base market too. This means you can supply tBTC as collateral and borrow USDC at competitive market rates, all on a fast, cost-effective Layer 2.

These integrations highlight how tBTC is evolving into a go-to wrapped BTC for lending, offering reliability and low-risk borrowing options that benefit the entire community.

tBTC debuted on Venus.io on Ethereum mainnet

If you’re into Venus.io, you’ll love this: tBTC is now available as collateral on their Ethereum mainnet platform. Borrow a wide variety of stablecoins like USDC, USDT, DAI, crvUSD, USDS, USDe and others against your tBTC holdings.

This listing underscores tBTC’s growing appeal in diverse lending environments, providing more choices for users to leverage their assets securely and earn yields without unnecessary complexity.

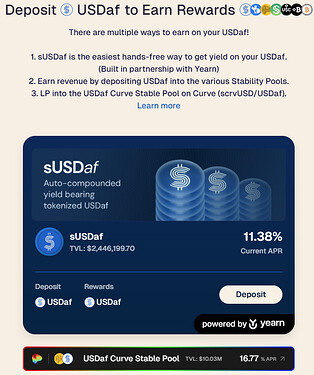

tBTC as collateral on USDaf from Asymmetry Finance

tBTC shines as a premium collateral option on Asymmetry Finance (a friendly fork of Liquity v2). Here, you can borrow the USDaf stablecoin at customizable fixed interest rates tailored to your needs.

Since launch, tBTC has seen strong adoption on Asymmetry, becoming a favored wrapped BTC choice thanks to its security and efficiency. Plus, you can supercharge your yields by depositing USDaf into stability pools, the auto-compounded yield bearing sUSDaf, or the USDaf Curve’s Stable pool. It’s a powerful way to turn your tBTC into a yield-generating machine!

tBTC as an asset on ZeroLend Bitcoin LRT market

Level up your tBTC usage on ZeroLend’s Bitcoin LRT market, where it serves as collateral with a 90% liquidation threshold - giving you more borrowing power and peace of mind.

These integrations are a testament to the Threshold DAO and Community hard work behind the scenes, expanding tBTC’s reach and creating real value for our community.

Whether you’re a long-time holder or new to Threshold, now’s a great time to dive in, supply your tBTC, borrow, or earn yields on these platforms. Would love to hear your experiences and feedback ! ![]()